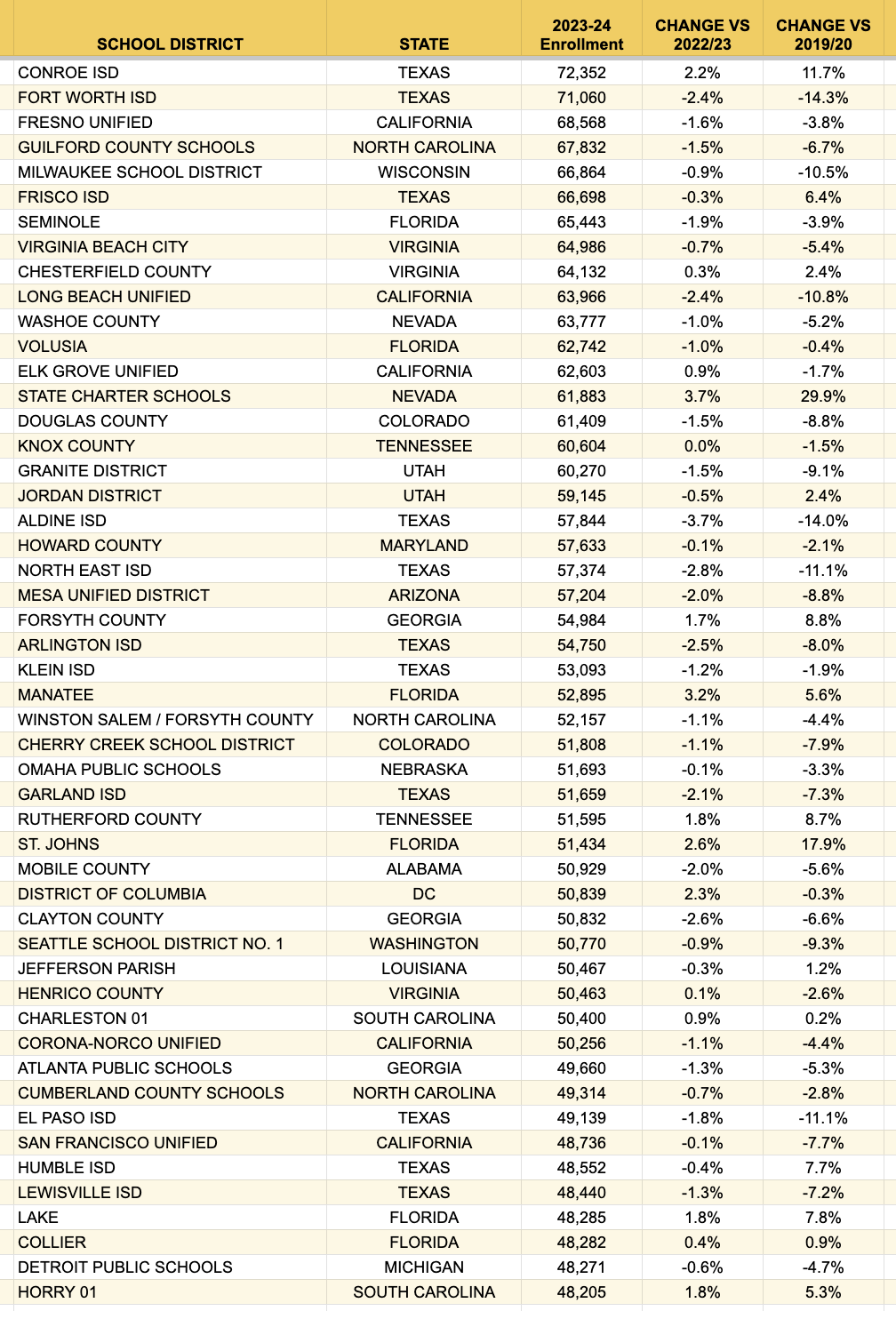

1. Late last month NCES published enrollments for the 2023-24 school year. Below is a list of the 50 largest districts in the U.S., with their enrollment change versus last year, as well as versus 2019/20, the year before Covid-19 disrupted in-person education.

Nine of the top 10 and 38 of the 50 largest districts have lost enrollment since 2019-20, while 31 of the largest 50 districts lost enrollment between 2022/23 and 2023/24. The district with the largest gain since 2019-20 is IDEA Public Schools, a not-for-profit charter operator.

Further below, we list districts 51-100. Here are the top 50:

2. One important use of Burbio's K-12 spending and strategy datasets is to understand district objectives and to use that information to proactively engage with potential customers before they begin an RFP process. To that end, this week we look at the frequency of school board mentions of cybersecurity-related terms. These are highly specific terms that, while not appearing frequently, are very meaningful when they do appear.

Burbio's School Board Meeting Tracker covers school board meetings for over 2,000 school districts each month, representing over 60% of the K-12 school population. The percentages in each chart refer to districts that mentioned the measured terms at least once in the one year period ending 10/31/24:

Below is a map of school districts that reference the above terms in meetings during the period:

Below is a map of school districts that reference the above terms in meetings during the period:

3. Burbio's database of district checkbook registers includes districts from over 40 states, representing close to 40% of PreK-12 students. The information is used to track competitive activity. This week we are sharing a market penetration analysis for select vendors and service providers. The following chart highlights the supplier name and the percentage of districts in our database with a payment to the supplier in question at least once during the twelve month period from October 2023 to September 2024:

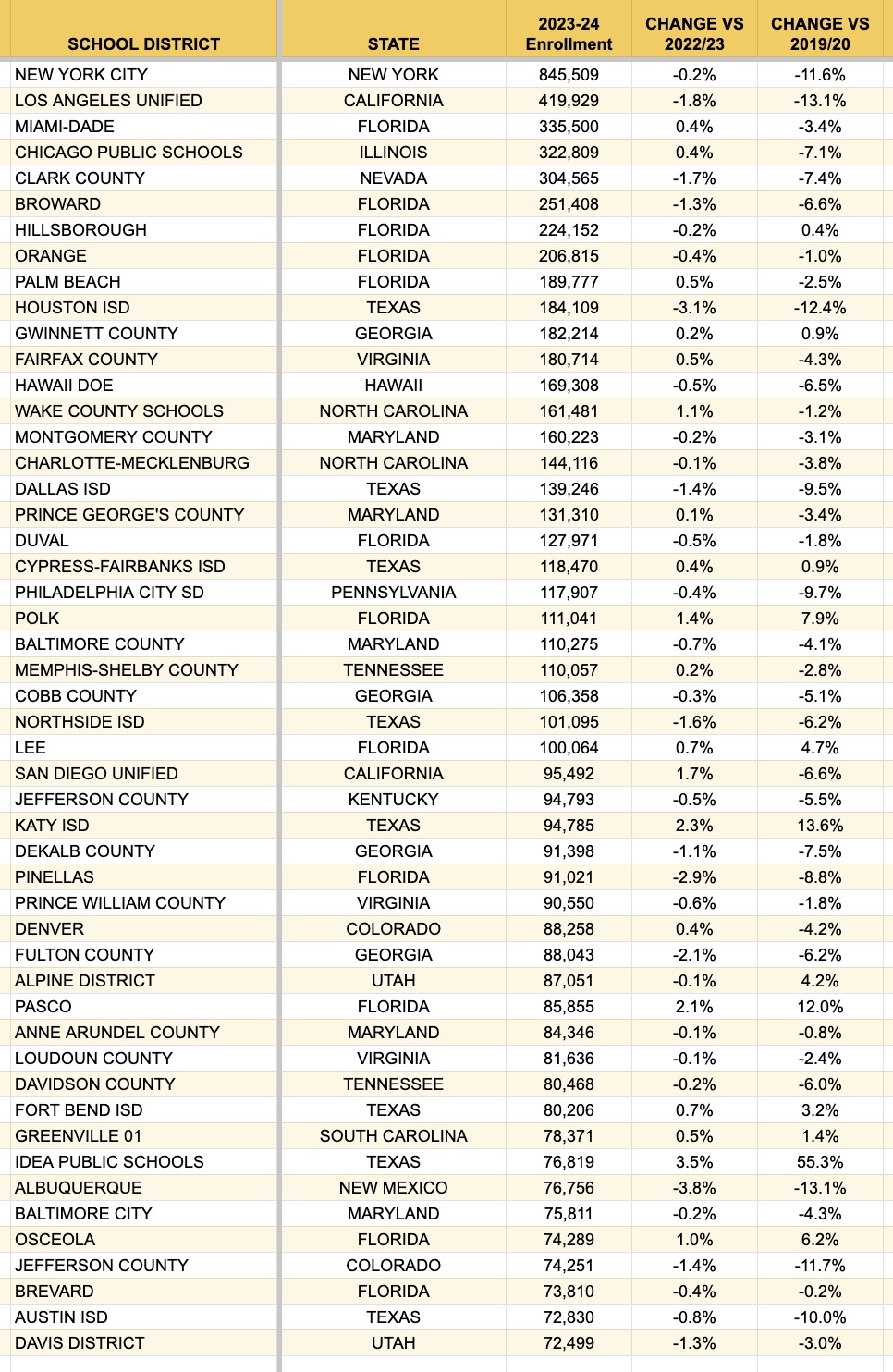

3. Burbio's database of district checkbook registers includes districts from over 40 states, representing close to 40% of PreK-12 students. The information is used to track competitive activity. This week we are sharing a market penetration analysis for select vendors and service providers. The following chart highlights the supplier name and the percentage of districts in our database with a payment to the supplier in question at least once during the twelve month period from October 2023 to September 2024: 4. Below is a continuation of enrollment trends featuring districts 51-100. Thirty-five of the 50 districts below saw enrollment declines versus both 2019-20 and 2022-23. The district with the largest enrollment increase is the charter school network out of Nevada.

4. Below is a continuation of enrollment trends featuring districts 51-100. Thirty-five of the 50 districts below saw enrollment declines versus both 2019-20 and 2022-23. The district with the largest enrollment increase is the charter school network out of Nevada.