1. A major issue facing PreK-12 suppliers is the end of Covid-era Federal stimulus spending. The largest piece of that funding, ESSER III, had an obligation deadline of September 30th, 2024, and a disbursement deadline of January 28th, 2025. Billions of dollars were spent in the first half of FY 2025.

Burbio gathered spending plans from over 7,000 school districts covering 83% of all PreK-12 students and $100 billion in planned spending. Burbio has worked with corporations and investors who have used these plans for due diligence in making investments or acquisitions in the education industry. Use of ESSER III plans went through three phases:

- Early in the ESSER III cycle, the plans were used by these clients to project revenue opportunities for sector participants.

- As the timeline progressed, the plans were used to evaluate ongoing participation in the growth of the market.

- As ESSER III wound down and through the current period, the plans are used to evaluate supplier revenue risk by understanding how much category spending was either "pulled forward" or is not ongoing revenue.

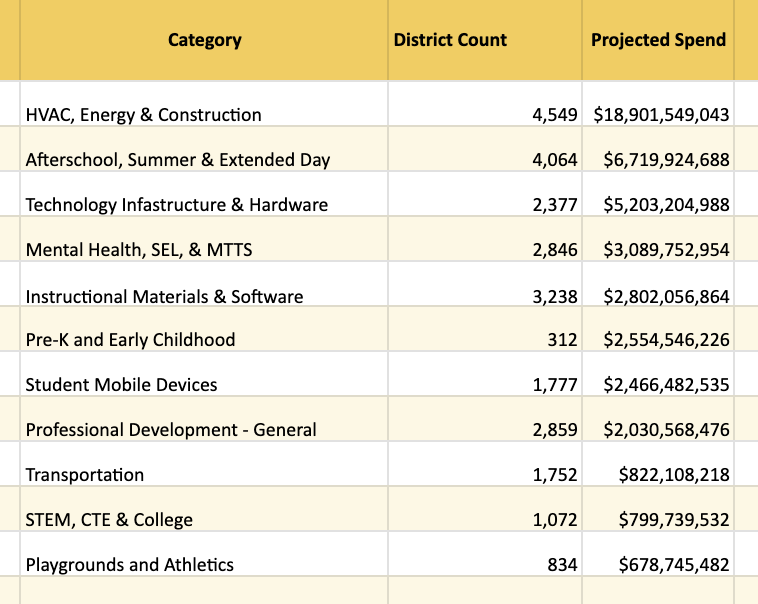

Heading into FY 26, suppliers in PreK-12 can use the plans in a similar fashion: account-level reviews that provide context for current results and support forecasts. The analysis can evaluate, for example, whether a district may have pulled forward purchases from future years or made a purchase that is difficult to replicate on an ongoing basis. For perspective, below is the amount of money spent from ESSER III in some major categories, along with the number of districts who spent in that area:

These plans were written quite specifically and our dataset covers almost 100 categories, in addition to the plans themselves. The summary above combines similar categories for simplicity, and an account-level analysis would provide more detail.

2. In a previous Tracker we introduced an AI-powered discovery tool that, when applied to Burbio's foundational school district intelligence dataset, delivers relevant, contextual and immediately actionable answers to any question at scale. This week we queried our database for school districts discussing staffing cuts heading into FY 2026.

Districts where cuts are being completed include:

- Euclid City School District, OH, terminated over 100 non-teaching staff effective June 30th 2025. The board noted, "The reason for the proposed RIF is due to financial reasons and decreased enrollment . . . "

- Mukilteo School District, WA, recently adopted a resolution for a $5 million budget cut involving 30 Full-Time Equivalents (FTEs), including 19 classroom teachers. The district’s student enrollment has declined by approximately 600 students since 2020, and the District projects the trend to continue.

- In March meetings, Arlington Public Schools, VA, presented a 2026 budget that is reducing staffing costs by just over $22 million, including 27.5 FTEs in the central office and 84.75 FTEs in the instructional workforce.

In examples of more fluid situations:

- Weymouth Public Schools, MA, is facing a $1.9 million shortfall for FY 2026 due to the "end of ESSER funding . . . inflation cost . . . and declining revenues." The district has identified cuts of 20 FTEs heading into a May presentation to the town.

- The City School District of New Rochelle, NY, presented a budget, due to be voted on in May, that cuts 200 positions to close a $20 million budget gap.

- Facing "persistent enrollment declines," Randolph County Schools, WV, began reduction-in-force meetings in late March to close a $2 million gap.

This tool can be used for any question about district activity at any stage of decision making, such as curriculum reviews, technology evaluations, capital spending plans, and program expansions. For a demo of this capability click here to schedule a meeting.

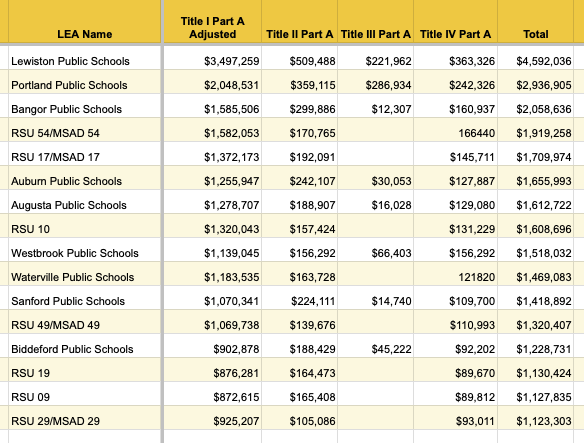

3. Uncertainty in public education is not restricted to the end of stimulus funding. On Friday, the Federal Department of Education announced its intention to "initiate an administrative proceeding to adjudicate termination of (Maine's) federal K-12 education funding, including formula and discretionary grants" over the state education department's refusal to comply with recent Federal executive orders related to Title IX. As legal activity around the move proceeds, we wanted to illustrate the scope of the funding at risk. Below we take a look at Title I, II, III and IV funding for districts in Maine with allocations of more than $1 million in FY 2025:

A core competency of Burbio is building pioneering datasets that measure PreK-12 disruptions - such as our School Opening Tracker, ESSER III plans, recent AI-enabled "signals" Tracker, and more. We are monitoring the impact of Federal policies on district activity and continue to introduce tools that allow for clients to react to changes.